Certified Public Accountant

and

Business Adviser

creative solutions, creative results.

About Us

We believe we not only deal with numbers but also with people. When client provide us a problem it is our job to deliver a solution. Our team’s forward thinking approach and comprehensive range of services have helped us to develop and grow.

Why choose us?

We will prepare your accounts and tax return correctly and on time. We will respond as quickly as possible to your queries whether by phone or email.

We aim to provide you with the best possible service and complete satisfaction.

We partner our clients, helping you make the right financial decisions and grow your business.

Our aim is:

- To solve your Accountancy needs

- Simplify accounts for your Business

- Help you maximize tax savings

- Provide you with the information you need to develop and grow your business

- Provide a professional personal service

- FIXED fees with no hidden extra charges

- Personal availability at no extra charge

Running a business but you are not good at Accounting?

We will take care of all your formalities.You may focus on what you're doing best - Running Your Business.

Wish to take your business to the next level?

Open up for new possibilities and convert your business activity from Self-Employed to Limited Company. Step into the world of Big Players!

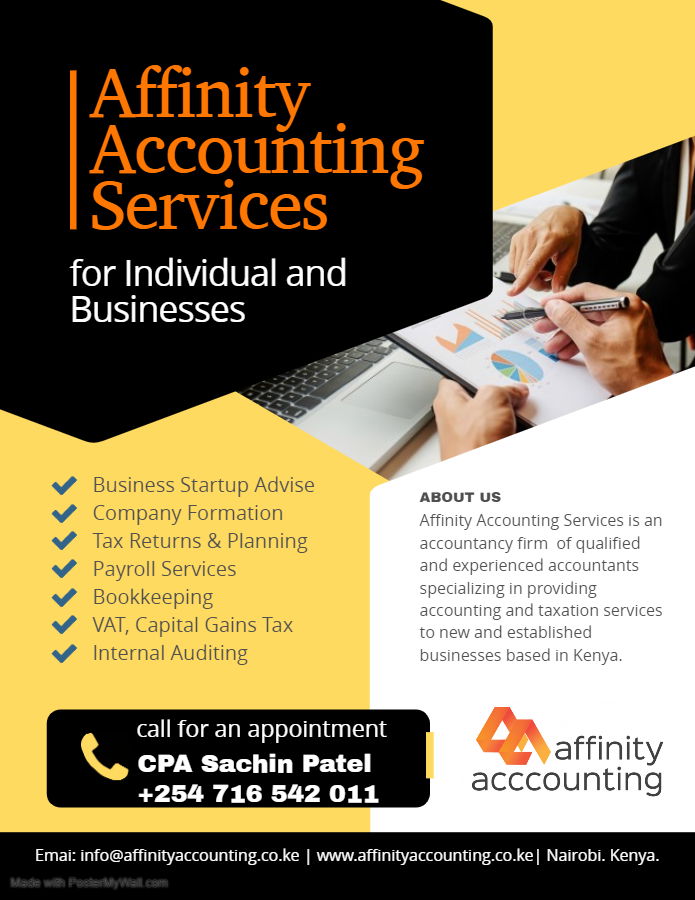

Services

Startup Advice

When launching a new business, selecting a suitable structure is vital, whether it is sole trader, partnership, limited liability partnership or limited company. Choosing the right option at the very beginning can save time, money and stress in the long-term. Our team of experts can provide back-up, advice and support on these decisions.

Learn MoreCompany Formation

If you are thinking about setting up your own business, the best place to start is talking to "AFFINITY ACCOUNTING SERVICES" Our experience of working with wide range of businesses to take an independent, expert view of your plans and give you practical, professional advice on your enterprise.

Learn MoreBookkeeping

Effective book keeping is at the heart of every efficient business, providing you with timely information on exactly where you stand with your financial commitments. Our team works with a growing number of small to medium sized businesses in the KENYA, offering full-cycle bookkeeping and accounting services.

Learn MoreVAT Services

VAT is one of the most complex and onerous tax regimes imposed on business - so complex that many businesses inadvertently overpay or underpay VAT.

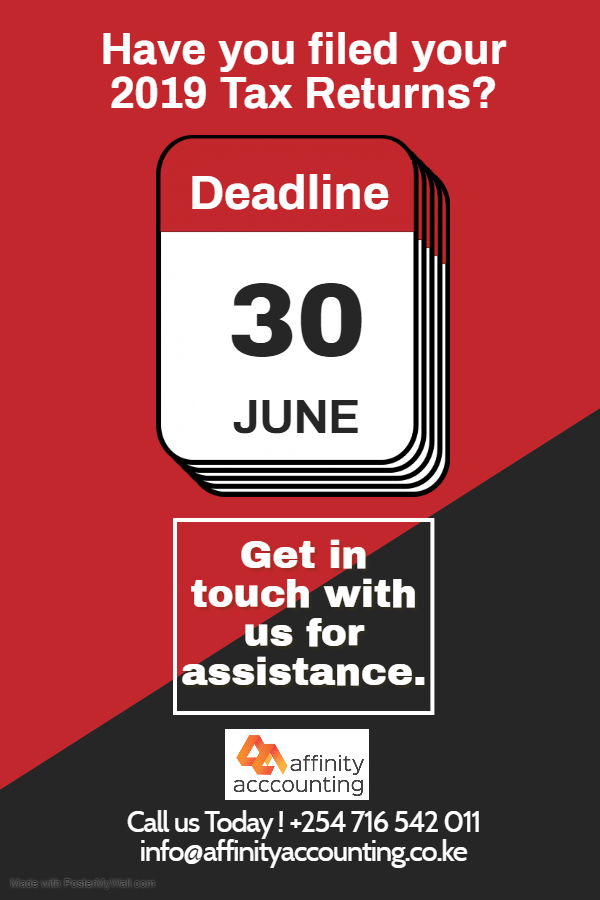

Learn MoreTax Return

We provide comprehensive tax return services for Limited companies, Partnership businesses, Sole traders and Individuals who are required to complete tax returns.

Learn MorePayroll & Paye

“Everything seemed fine running your own business until the day you took on your first employee and became an unpaid tax collector”.

Learn MoreResources

Tax Rates and Allowances • Capital Allowances • Corporation Tax • Income Tax Rates and Bands • Inheritance Tax • VAT • Capital Taxes • Duties • Individuals • Investments • Insurances • Registered Pension Schemes

Learn MoreInternal Audit

We provide internal audit services. We understand our clients’ operations, their industry and the issues they face, and this enables us to provide them with an assurance on their controls, business processes and the integrity of their accounting systems. Internal audit services will help your organisation to identify and take action to protect itself from the greatest risks to its strategy, finances and operations.

Learn MoreCatering Levy (CTL)

The Catering Levy is calculated at the rate of 2% and is payable by Restaurant/Bar establishments making minimum gross sales of Ksh. 3 Million per annum or an average of Ksh. 250,000 for the first three (3) trading months, in case of new establishments. This Levy is paid to the Tourism Fund by the 10th day of the following subsequent month of sale.

VOLUNTARY TAX DISCLOSURE PROGRAMME (VTDP)

This is a programme where a taxpayer confidentially discloses tax liabilities that were previously undisclosed to the Commissioner for the purpose of being granted relief of penalties and interest of the tax disclosed.

DIGITAL SERVICE TAX

A digital marketplace is a platform that enables direct interaction between buyers and sellers of goods and services through electronic means.

Our Team

Amos Nziu

Senior Accountant

Bachelor of Commerce - B.com Forensic and Investigative Accounting - FIA

“Our aim is to build business relationships that are both strong and resilient, and that are built on trust. We do all we can to achieve this by delivering professional, reliable and efficient services, which in turn allows us to grow as a business, as we help our clients’ businesses to flourish as well.”

Articles

Our Affiliations

Contact Us

- 4 Greenway road, Nairobi, Kenya

- P.O.Box : 38112 - 00623 , Office No. 4

- +254- 0716542011 - CPA Sachin Patel

- info@affinityaccounting.co.ke

- 8:00 Am to 4:30 Pm (Monday to Saturday) Sunday & Public Holiday closed Thanking You.